5.30 AM, on a crispy morning, year 2030. Jason gets out of bed and walks into the bathroom. Lights turn on automatically and Alexa says, “Good Morning Jason, here is your calendar for today…” By the time he reaches for his toothbrush, Alexa is already reading the latest news for the day and the traffic and weather conditions, exactly the way he set his preference. Dang, my after-shave is almost finished, let me squeeeeze the last bit out of the tube. “Alexa, pause. BUY my favourite after-shave (favourite is already preset to ‘Gillette after-shave gel – sensitive skin’ on Amazon) and continue”. Alexa continues with updates on global financial news, the Collingwood football club score from the game last night, stock prices for Apple, Vanguard ETF and BHP Billiton, travel time to the office and rain forecast for the day. “Accident on the freeway, your trip will have an additional drive time of 30 minutes Jason”, warns Alexa. “Forget the brekky, I’ll grab one at the café near work. Gotta run now or I’m going be late for my 9 O’clock meeting”, Jason thinks to himself. “Alexa, in 15 minutes, START the TESLA and ACTIVATE fastest route to my OFFICE, OPEN the GARAGE and READ me in the car, all news on market share and announcements, total employees in Australia, and share prices for last 10 years for BHP Billiton and any news articles on Andrew Stewart Mackenzie, CEO of BHP Billiton”. “Turn home lights OFF in 16 minutes”. Jason is a Sales Manager in an IT Company who has a C-suite meeting with one of his major accounts today and this was a typical morning for him.

The days of reading the morning newspaper over a cuppa is well and truly over. From a face-less newspaper subscriber to ‘David who has a 12-month subscription to the newsletter with interests in Finance, Cricket and Tech gadgets’ is how intimately businesses know their customers. Customers still exist, their eyeballs have just moved to new places. If you already look away from the TV (to your phone) when an Ad comes on, or watch Netflix to get away from Ads, or read news from the online edition of the Financial Times, you know where the eyeballs have moved to. Consumer behaviours have evolved and will continue to do so, hence the need for products and services to adapt and ‘live’ where the consumers live to be consumed the way customers want to consume them.

Will Everitt, Head of Product and Technology, Pacific Magazines, discussed the transformation to a product-thinking organisation with the values of a technology start-up at a recent CIO Leaders Summit Australia in Melbourne facilitated by Focus Network. Yahoo took on the digital rights for Pacific Magazines in 2006 as part of the formation of Yahoo7, which is a joint venture between Yahoo and Seven West Media. This meant that Pacific Magazines was focused mainly on print with no digital DNA for a decade. In 2016, Pacific Magazines brought the digital rights back in-house from Yahoo7. He shared the epic journey of how a magazine publisher became a media technology company.

“We focused on 4 areas – Product, Process, People and Technology”, says Will emphasizing the need for a plan in the absence of which we plan to fail or make ourselves extinct.

- Product – Identifying the consumer behaviours and defining product strategies around them are keys to successful transformation. Mobile, Video and Data Analytics were three main pillars of this strategy. Consumer trends are heavily increasing on mobile, people are time-poor and want to consume content on the go. A mobile first strategy is key to success with focus on unique value propositions. The video advertising spend growth rate is at, and continues to grow at, double-digit figures. The dollars are there – so we needed to provide inventory to capitalise on this demand. Placing the audience at the heart of everything we do. Maximise the value of our audience to improve monetisation. Developing concepts targeted at audience growth among high value consumers. Data is the key asset. Finding it, analysing it, consolidating it and monetising it is paramount. Get data in one place and create services to dynamically expose information.

- Process – We had clear roadmaps which everyone signed up to with regular innovations days.

- People – We brought in new talent, re-booted the organisation and established a supportive culture. This created a high performing team that drove agile adoption.

- Technology – We introduced the right operational infrastructure to support rapid development. This enabled to establish a scalable and high quality platform with speed to market. Strategically embracing the cloud-enabled infrastructure on Amazon Web Services, Test Automation (unit and e2e) triggered from the build server and Continuous delivery by automating integration and deployment resulted in an unprecedented transformation of the Pacific Magazines business.

“Focus on these aspects and change into a Tech savvy, high performing , startup like organisation to execute the vision for growth and success”, concluded Will in his engaging and thought-provoking session at the CIO-CISO Leaders Summit on how companies need to find their inner technology mojo to ensure survival in the fast changing marketplace.

“If I had 9 hours to chop down a tree, I’d spend the first 6 sharpening my axe” – Abraham Lincoln

6.30 PM, a cloud-less night in 2030. Jason returns home. He has been thinking about getting married. Throw in voice instructions from wife and kids into the Alexa algorithm, aaahh!. “Welcome home Jason”, says Alexa interrupting his thought train. “Playing recording of the Boston Red Sox game you missed today” informed Alexa while the TV turns on and his attention is completely diverted into the game. “GO XANDER (Bogaerts)!”, yelled Jason, settling down into his recliner with a highball glass of Jack Daniels neat. The wedding and kids and their toys can wait for another day.

Focus Network is a leading B2B event company that builds and creates C level communities throughout the APAC region for commercial connections to our clients to engage directly with C-level executives throughout a key number of verticals. Some of the excerpts in this article have been shared from one of our recent well-acclaimed CIO Leaders Summits Australia held in Melbourne

– Jilfy Joseph

For more information about the CIO Leaders Summit Australia please register your interest at http://cioleadersaustralia.com/

For all media enquiries please contact:

Stacey Alker – Marketing Director, Focus Network

E: stacey@focusnetwork.co

P: +61 (0) 484 963 072

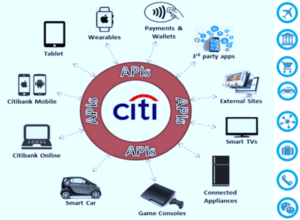

Citibank has created multiple revenue streams using APIs to support building new partnerships for growth and customer acquisitions. Study shows that banks that embrace the Open Banking APIs are expected to grow revenue by over 20% while those that are uninterested will decline by 30% by giving away their market share to disruptive challengers emerging in the market by 2020.

Citibank has created multiple revenue streams using APIs to support building new partnerships for growth and customer acquisitions. Study shows that banks that embrace the Open Banking APIs are expected to grow revenue by over 20% while those that are uninterested will decline by 30% by giving away their market share to disruptive challengers emerging in the market by 2020.